Business Insurance in and around Clark

Get your Clark business covered, right here!

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Whether you own a a clock shop, a pharmacy, or a hearing aid store, State Farm has small business protection that can help. That way, amid all the different moving pieces and options, you can focus on your next steps.

Get your Clark business covered, right here!

Almost 100 years of helping small businesses

Protect Your Business With State Farm

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, commercial liability umbrella policies or surety and fidelity bonds.

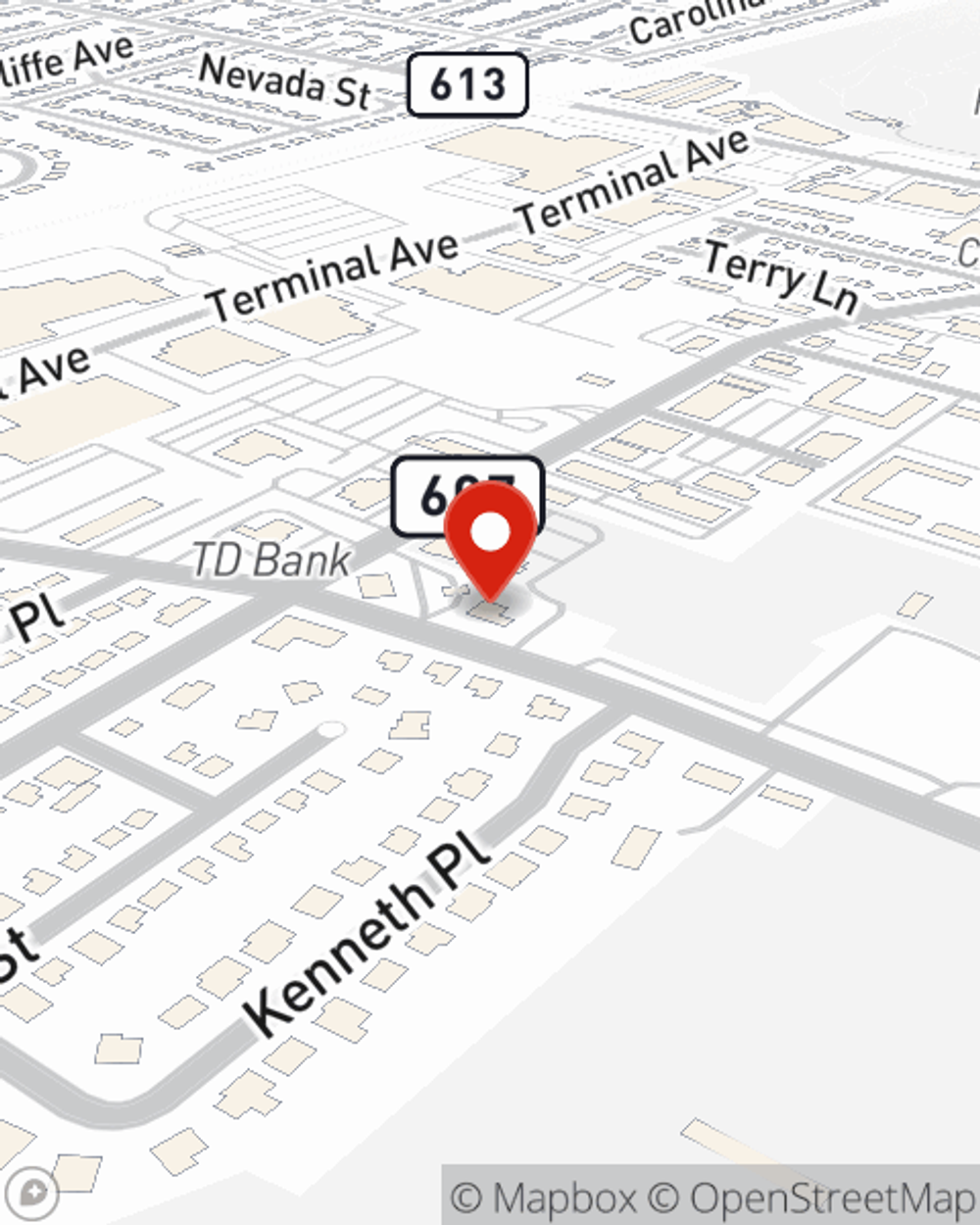

The right coverages can help keep your business safe. Consider stopping by State Farm agent Michael Lyne's office today to discuss your options and get started!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Michael Lyne

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.